DOGE Price Prediction: Analyzing the Path to $1 Amid Technical and Fundamental Crosscurrents

#DOGE

- DOGE trading below 20-day MA with negative MACD indicates bearish short-term momentum

- ETF speculation and whale accumulation provide fundamental support despite security concerns

- Reaching $1 requires 373% appreciation from current levels, making it unlikely without major catalysts

DOGE Price Prediction

Technical Analysis: DOGE Faces Key Resistance at 20-Day Moving Average

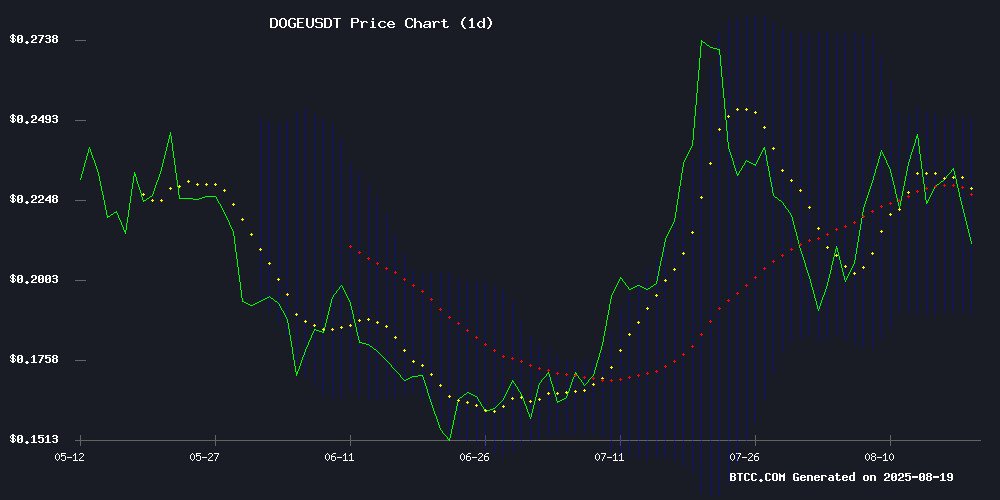

According to BTCC financial analyst John, Doge is currently trading at $0.21159, below its 20-day moving average of $0.219884. The MACD indicator shows negative momentum with a value of -0.010230, suggesting bearish pressure in the short term. The Bollinger Bands indicate DOGE is trading closer to the lower band at $0.189688, which could serve as support. The middle band at $0.219884 represents immediate resistance that bulls need to overcome for any meaningful upward movement.

Market Sentiment: Mixed Signals Amid ETF Speculation and Security Concerns

BTCC financial analyst John notes that market sentiment for DOGE is currently divided. Positive ETF speculation and whale accumulation are providing upward momentum, while security concerns have triggered a 5% pullback. The heavy trading volume and market-wide liquidations indicate heightened volatility. The possibility of a 30% MOVE exists, but direction remains uncertain without a clear breakout above key technical levels.

Factors Influencing DOGE's Price

Dogecoin (DOGE) Price Prediction: Security Fears Trigger 5% Pullback

Dogecoin faced a 5% price drop amid security concerns after the Qubic community voted to launch a 51% attack on the network. The meme coin, which had recently seen bullish momentum, now tests key support at $0.21.

Whale activity offers a counterpoint to the bearish sentiment. A single entity accumulated $200 million worth of DOGE earlier this month, briefly pushing the price to $0.23. Such moves often signal institutional positioning ahead of potential catalysts.

The TD Sequential indicator flashed a buy signal at current levels, suggesting a possible short-term rebound. Market strategists note the divergence between retail caution and whale confidence creates an intriguing technical setup.

Dogecoin ETF Speculation Fuels Price Surge as Whales Accumulate

Dogecoin's market dynamics are shifting as institutional interest converges with speculative ETF chatter. Nearly 2 billion DOGE, worth approximately $460–500 million, has been absorbed by whales in recent days, triggering sharp price rebounds and bullish derivatives activity.

Technical indicators now suggest a path toward $0.3058, with sustained positive funding rates since early July and futures open interest hitting $3.39 billion. The emergence of an inverse head-and-shoulders pattern reinforces this trajectory.

Market optimism stems from multiple fronts: Bitwise, Grayscale, and 21Shares are reportedly evaluating DOGE ETF products, with analysts pricing 60–70% approval odds by 2025. Corporate adoption is accelerating, highlighted by Bit Origin's $500 million treasury allocation plan.

Critical thresholds loom at $0.25–$0.26—a breach would validate the $0.30 target, while failure to hold $0.24 could unravel the bullish thesis. The meme coin's transformation from internet joke to institutional asset continues to defy expectations.

Dogecoin Tests Key Support Amid Heavy Trading Volume and Market-Wide Liquidations

Dogecoin plunged overnight, shedding recent gains despite significant institutional accumulation, as a surge in trading volume triggered a cascade of stop-loss orders. The meme coin dropped 4% to $0.22, with 782 million DOGE changing hands during the sell-off—nearly double the daily average.

The move coincided with broader crypto market turbulence, as $1 billion in liquidations rippled across exchanges following stronger-than-expected U.S. inflation data. Institutional buyers absorbed some of the selling pressure, accumulating 2 billion DOGE worth $500 million this week.

Technical charts show DOGE's breakdown below $0.23 invalidated its prior bullish structure, with the $0.22 level now emerging as critical support. Resistance is forming near $0.23 where sell orders cluster, while the late-session rebound suggests lingering demand at lower levels.

Dogecoin Price Pattern and ETF Filings Signal Possible 30% Move

Dogecoin's price action tightened into a symmetrical triangle in August 2025, with technical analysts anticipating a volatility surge upon pattern resolution. The meme cryptocurrency hovered near $0.22 as traders monitored converging trendlines, where a breakout could trigger a 30% swing according to market observer Ali Martinez. Fibonacci levels placed immediate resistance at $0.25 and support at $0.20.

Institutional interest intensified as Grayscale entered the Dogecoin ETF race, competing with existing filings from Rex-Osprey and Bitwise. Polymarket traders priced approval odds at 75% for 2025, with $141,000 in contracts traded. The filings mark growing mainstream recognition for the asset, originally created as a joke in 2013.

Will DOGE Price Hit 1?

Based on current technical indicators and market conditions, reaching $1 appears highly unlikely in the near term. DOGE would need to appreciate approximately 373% from its current price of $0.21159. The negative MACD, position below the 20-day MA, and mixed fundamental signals suggest continued consolidation rather than explosive growth. While ETF speculation provides some optimism, the technical hurdles and market volatility make a $1 target unrealistic without significant catalyst-driven momentum shifts.

| Current Price | Target Price | Required Gain | Technical Outlook |

|---|---|---|---|

| $0.21159 | $1.00 | +373% | Bearish/Neutral |